How High-Income Earners Can Legally Save Up to $25,000 in Tax Each Year

- Leonie Martin

- Sep 20, 2025

- 5 min read

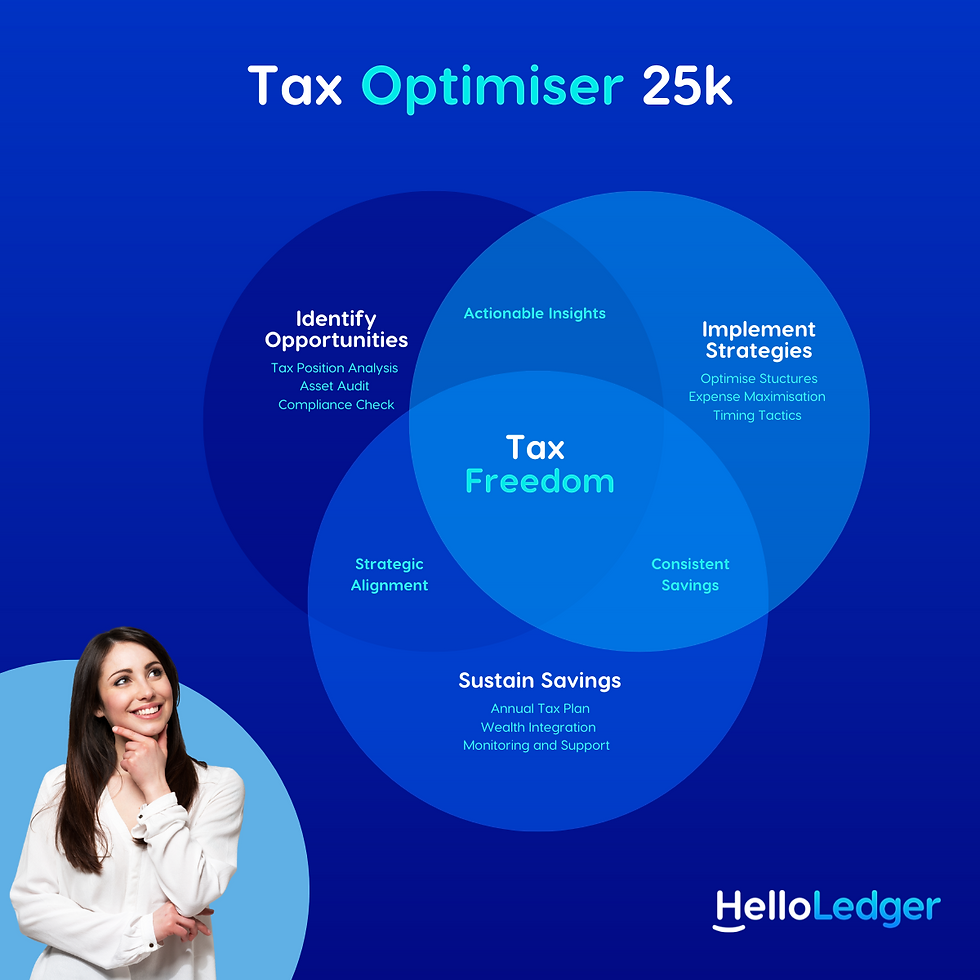

High-income earners often face a larger tax burden, but with proper planning and understanding of Australia’s tax system, it is possible to reduce taxable income legally and save significant amounts each year—sometimes up to $25,000. In this guide, we’ll explore strategies, explain key concepts like how does tax free threshold work, and provide insights to help you optimise your tax position while staying fully compliant with Australian tax laws.

Understanding the Tax System for High-Income Earners

Before implementing strategies to save on tax, it’s essential to understand how your income is taxed. Australia uses a progressive tax system where higher incomes are taxed at higher rates.

Income up to certain thresholds is taxed at lower rates.

Once you exceed these thresholds, the marginal tax rate increases, which affects high-income earners significantly.

Knowing your marginal tax rate and how different types of income are taxed can help you make informed decisions to reduce your tax liability.

Key Concepts You Should Know

1. How Does Tax Free Threshold Work

The tax free threshold allows individuals to earn a certain amount each financial year without paying income tax. For most Australian residents, the threshold is $18,200.

If you’re a high-income earner, you may not benefit directly from this threshold as most of your income exceeds it. However, understanding how does tax free threshold work is important when planning salary packaging, investments, or splitting income with a spouse to optimise tax savings.

2. How to Read a Tax Return Australia

High-income earners often have multiple sources of income, deductions, and offsets. Learning how to read a tax return Australia can help you identify opportunities for deductions, offsets, and superannuation contributions that reduce taxable income.

Key sections to review include:

Total income

Deductions and offsets

Tax withheld and PAYG installments

Medicare levy and other taxes

By understanding your tax return, you can pinpoint areas where legal strategies may reduce your tax liability.

3. How is Div 293 Tax Calculated

For high-income earners, Division 293 tax applies to concessional super contributions above a certain threshold. This additional tax is designed to ensure that high earners don’t receive excessive tax concessions on super.

Knowing how is div 293 tax calculated helps you plan your super contributions effectively. Strategies may include salary sacrificing into super or managing total income to minimise exposure to this tax, while still benefiting from retirement savings incentives.

4. Why is My Tax Return So High

If you’re asking why is my tax return so high, it could be due to several factors:

High income pushing you into the top marginal tax rate

Excessive taxable fringe benefits or investment income

Insufficient deductions or offsets

Additional levies such as Medicare or Division 293

Understanding why your tax return is high allows you to implement legal strategies to reduce your liability in future financial years.

5. Low Tax Return

On the other hand, a low tax return might indicate that you’ve maximised your deductions and tax offsets efficiently. However, low returns can sometimes mean overpaying tax throughout the year. By planning ahead, you can manage cash flow more effectively while reducing total tax payable.

Strategies to Legally Save Up to $25,000 in Tax

1. Maximise Super Contributions

Concessional super contributions are taxed at 15%, which is usually lower than your marginal tax rate. High-income earners can use salary sacrifice arrangements to contribute more to super, potentially saving thousands in tax each year.

Understand how is div 293 tax calculated to avoid paying excessive tax on high contributions.

Adjust contributions to stay below thresholds that trigger additional taxes.

This strategy not only reduces taxable income but also builds retirement savings efficiently.

2. Salary Packaging and Fringe Benefits

Salary packaging allows you to pay for certain expenses, such as cars, laptops, or work-related expenses, directly from pre-tax income. This reduces taxable income and, consequently, the tax payable.

Commonly used by high-income earners in professional sectors.

Ensure benefits are structured correctly to comply with tax laws.

Salary packaging is particularly effective when combined with an understanding of how does tax free threshold work, ensuring you optimise pre-tax benefits.

3. Claim All Eligible Deductions

Deductions reduce taxable income directly. High-income earners often overlook allowable deductions. Common deductions include:

Work-related expenses (uniforms, tools, travel)

Home office costs

Investment property expenses

Donations to registered charities

Knowing how to read a tax return Australia helps identify where deductions can be claimed and ensures you are taking full advantage of tax laws.

4. Invest in Tax-Effective Investments

Certain investments offer tax advantages, such as:

Negative gearing on investment properties

Dividend imputation credits from shares

Capital gains tax (CGT) strategies

Understanding how is div 293 tax calculated and other tax rules allows high-income earners to structure investments efficiently, minimising taxable income and maximising after-tax returns.

5. Income Splitting

If you have a spouse with a lower marginal tax rate, income splitting can reduce overall household tax. Strategies include:

Distributing investment income to the lower-income spouse

Spousal super contributions to take advantage of offsets

Income splitting leverages how does tax free threshold work for both partners, legally reducing total tax payable.

6. Prepay Expenses

High-income earners can prepay work-related expenses or business expenses before the end of the financial year to bring forward deductions. Examples include:

Professional subscriptions

Insurance premiums

Business travel or education costs

Prepaying expenses effectively reduces taxable income for the current year, increasing your legal tax savings.

7. Review Your Tax Withholding

If you often wonder why is my tax return so high, it may be due to insufficient tax planning during the year. Review your PAYG withholding amounts to ensure that you are not overpaying or underpaying tax.

Regular reviews with an accountant or tax advisor can help you manage cash flow and minimise year-end surprises.

8. Use Tax Offsets

High-income earners may be eligible for offsets that reduce tax payable. Some common offsets include:

Private health insurance rebate

Spouse tax offset

Low-income offsets for family members

Even if offsets are small, combined with other strategies, they can contribute to substantial savings.

Planning for a Low Tax Return

High-income earners often aim for a low tax return, meaning they minimise tax payable while staying fully compliant. Achieving this requires:

Careful tracking of deductions

Strategic super contributions

Planning investment income

Using salary packaging effectively

A tax professional can help ensure you are not overpaying tax and taking advantage of every legal strategy available.

The Role of Professional Advice

Tax planning for high-income earners is complex. Professional guidance ensures strategies are implemented correctly and legally. Experts can help with:

How to read a tax return Australia effectively

Planning super contributions and managing Division 293 tax

Identifying deductions and offsets to reduce taxable income

Structuring investments for maximum tax efficiency

Working with an accountant or financial advisor can provide personalised strategies that save thousands in tax each year.

Key Takeaways

High-income earners can save up to $25,000 or more in tax legally with proper planning.

Understanding how does tax free threshold work, how to read a tax return Australia, and how is div 293 tax calculated is crucial.

Strategies include maximising super contributions, salary packaging, claiming deductions, tax-effective investments, income splitting, and prepaying expenses.

Regular review of tax withholding prevents surprises like why is my tax return so high.

Aiming for a low tax return is possible with strategic planning and professional advice.

By applying these strategies, high-income earners can reduce their tax liability, improve cash flow, and maximise savings while staying fully compliant with Australian tax laws.

Conclusion

Australia’s tax system may seem complex, but with knowledge and careful planning, high-income earners can legally save thousands each year. Understanding key concepts such as how does tax free threshold work, how to read a tax return Australia, and how div 293 tax calculated allows you to implement strategies that reduce taxable income.

Whether you’re wondering why my tax return is so high or aiming for a low tax return, using deductions, super contributions, salary packaging, and tax-effective investments can help you save significantly. With professional guidance, you can navigate the tax system confidently and optimize your financial position.